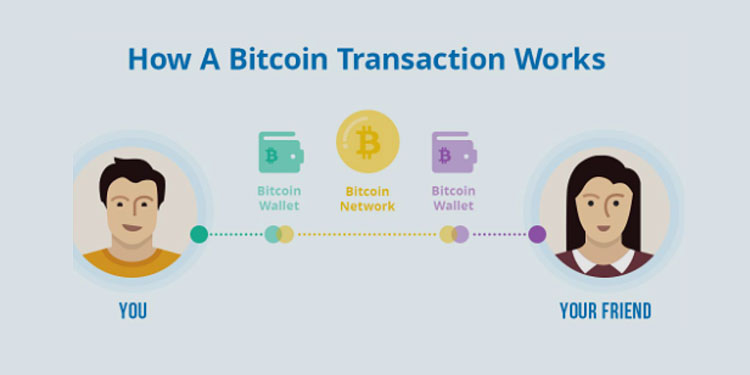

Learning how Bitcoin transactions work is one of the basics of investing in crypto. Although it may seem absurd, many traders and investors don’t really understand how cryptocurrency becomes the buyer’s property.

A Bitcoin transaction is always worth reviewing. Even though many guides on cryptocurrency cover this topic, it’s a good thing to keep in mind before you begin buying Bitcoin.

Discover how Bitcoin transactions work, how long they take, and how they are verified to ensure that they are safe and secure.

Basics of Bitcoin

It’s worth revisiting the Bitcoin blockchain before getting into the nitty-gritty details of Bitcoin transactions.

Bitcoin is a digital currency stored in an online Bitcoin wallet. Bitcoins are essentially just small bits of computer code. Neither can you hold the currency in your hands, nor can you put it in an envelope – but it can be used as a medium for transactions. It can be used to buy or sell things, provided that the other party accepts it.

Bitcoin is also a decentralized currency, which means that it has no regulatory authority like a bank. Like stocks, its value is determined by the market. As the first cryptocurrency, Bitcoin was first made available to the public in 2009.

It is also important to note that Bitcoin is built on a technology called “blockchain”.

Blockchain

The most basic form of blockchain technology is a chain of blocks containing data. The blockchain itself is decentralized – it is not controlled by a single entity. There are hundreds or even thousands of users participating in a blockchain network that spans the globe.

Cryptocurrency transactions are enabled by blockchain. Using a distributed ledger, it keeps track of these transactions by storing the data in blocks. Imagine an Excel spreadsheet stored on thousands of different hard drives, all of which reference each other to verify the accuracy of the data.

Faster, more secure (but not 100% secure) transactions are possible using blockchain technology. Blockchain and Bitcoin are frequently mentioned together because of this.

Crypto Exchanges

A Bitcoin transaction is usually executed on a cryptocurrency exchange. It’s not the same story if you’re mining Bitcoins, though.

What are cryptocurrency exchanges? Similar to any other financial exchange.

Cryptocurrency exchanges allow parties to trade cryptocurrencies. As with a stock market, investors and traders can buy and sell cryptocurrencies, usually in exchange for dollars or other fiat currencies. There are many crypto exchanges, each with their own rules and offerings.

On the exchange, traders create an account, fund it, and then execute a transaction for Bitcoin or any other cryptocurrency they wish to add to their portfolio.

Transaction Confirmations

It can take a little while for the network to verify or confirm Bitcoin transactions. Since the miners need to get to work, a transaction won’t be confirmed until a new block is added to the blockchain.

For creating new blocks on the blockchain, miners are rewarded with new Bitcoins. They confirm and verify the data in the blocks. The network has an incentive to constantly confirm and verify the data on the network, including transaction information.

The transaction will remain unconfirmed until the network creates a new block and verifies the data.

Transaction Speeds

Generally, the duration of a transaction depends on a few factors, such as the value or amount of Bitcoin involved. The reason for the delay is largely due to the structure of the Bitcoin network itself – a new block is generated approximately every 10 minutes on average.

There is also often a queue to confirm your transaction. There may be instances in which you can pay a higher fee to get priority treatment.

Bitcoin Transaction Fees

As long as there is “block demand” in the Bitcoin network, where users want to confirm their transactions and thus have the data written into new blocks, backups can be created. A higher demand leads to higher transaction fees, or prices to confirm a transaction. Essentially, traders pay a “miner’s fee” to have a transaction processed and confirmed on the blockchain, and the busier the network, the higher the fee.

Due to the crypto bull rush, fees skyrocketed during late April of 2021. On average, fees were around $60. During quieter times on the network, the costs are usually much more reasonable, less than $5.

Supply and demand determine everything in the end. The higher the transaction costs, the greater the demand on the network at a given time.

The Takeaway

Bitcoin transactions rely heavily on the blockchain network, but at their core they are nothing more than transferring Bitcoins from one account to another. Transaction fees and transaction speed can vary based on demand.

Following your reading of all the good stuff related to crypto taxes and applicable cryptocurrency regulations, you might be ready to make your own Bitcoin transactions.