In this issue

- Three Arrows: Snowball effect

- Solend: Whale tale

- China’s NFT traders: Flipping the script

From the Editor’s Desk

Dear Reader,

“Disruptive” is arguably one of the most overused words in the contemporary business lexicon. It’s bandied about in the cryptocurrency space as much as anywhere else, to the point at which its absence is almost conspicuous if it’s omitted from any description of a venture.

Yet in crypto, at least, it’s a valid characterization of the entire industry — as it is of the Web 3.0 paradigm within which crypto, blockchain and decentralized finance exist.

Disruption in these sectors kicked into high gear last year as the crypto market soared to all-time highs and mainstream adoption grew. Disruption of a different sort is currently rocking that same market, sending coin valuations to lows not seen since 2020.

As the crypto sector has suffered, a number of observers have been quick to criticize it, often in an echo of early crypto-skeptics, pointing to its supposed lack of intrinsic value and smearing the entire industry as a Ponzi scheme.

Although we obviously acknowledge the unwelcome disruption that has accompanied crypto’s present woes, we humbly suggest that doubters might like to remind themselves of another phrase before they leap to announce the imminent demise of the crypto phenomenon: “Dot-com crash.”

The unraveling of the dot-com boom at the turn of the millennium was a traumatic episode for many investors and enterprises, a large number of which simply disappeared. Yet it constituted an instance of disruption from which Web 2.0 was born, spawning many of the business models and companies that we have since come to regard as indispensable to our daily lives.

What we are witnessing in the crypto space — and in Web 3.0 more broadly — is perhaps not dissimilar. It would be difficult to name an emerging industry — let alone an entire industrial paradigm — that did not suffer from growing pains, and today, the incredible interconnectedness of our world makes such pains all the more acute and widely felt.

Once again, we turn to the analysis of Austrian political economist Joseph Schumpeter, best known for his theory of “creative destruction.” Schumpeter argued, in essence, that in order to improve and innovate, some things have to go to the wall. In this sense, creativity and destruction — or, for our purposes, disruption — are not mutually exclusive, as strict semantics might suggest, but inextricably bound together.

And to borrow shamelessly from another Germanic thinker: That which doesn’t destroy — or terminally disrupt — crypto and Web 3.0 will only make them stronger.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast

1. Big chill

Image: Canva

By the numbers: Three Arrows Capital — over 5,000% increase in Google search volume.

Worried by unstable market conditions, cryptocurrency lenders and platforms are following Celsius Network’s lead by freezing or limiting withdrawals. Amid similar mounting pressures, major digital asset-focused hedge fund Three Arrows Capital is now also facing a risk of insolvency.

- Hong Kong-based Babel Finance, which last Friday cited “unusual liquidity pressures” and froze withdrawals and redemptions, this week announced that it had reached preliminary agreements on debt repayments.

- Market jitters increased last week following rumors suggesting that Three Arrows, which was founded in Singapore, could be facing insolvency due to its large investments in Lido Staked Ethereum (stETH). That came after the company’s bet on Terra ended in shambles as Terra’s UST algorithmic stablecoin imploded last month.

- StETH, an ETH-pegged cryptocurrency that represents ETH staked in Ethereum’s proof-of-stake chain, started to lose ETH parity earlier this month, triggering a cascade of margin calls and liquidations.

- Three Arrows’ two co-founders have reportedly been ghosting creditors. Su Zhu — normally a vocal member of the crypto community on social media — hasn’t been heard from since a June 15 Twitter update that said: “We are in the process of communicating with relevant parties and fully committed to working this out.”

- Although the cryptocurrency industry has been grappling with sector-specific problems including the stETH de-peg, macroeconomic conditions such as increasing inflationary pressures and rising interest rates have contributed to a slump in the value of Bitcoin and other cryptos. BTC was changing hands for just US$17,760 on Sunday, its lowest price since November 2020, according to CoinGecko data.

Forkast.Insights | What does it mean?

Crypto investors are worried, as they have every right to be. Token prices are continuing to fall, and even the loudest crypto bulls have seemed relatively muted in recent weeks. But fears over asset withdrawal freezes are misguided.

Although critics say companies imposing such restrictions are violating user agreements, any student of history will know that financial services businesses have form when it comes to freezing withdrawals.

Perhaps most prominently in recent memory, some European and Asian banks froze or limited withdrawals during the 2008 financial crisis, and more recently, stressed Chinese lenders have done the same thing. Even stock markets aren’t immune from severe shocks and trading halts when things get ugly.

Such drastic actions are undoubtedly painful, suggesting that companies likely have few alternatives and are fighting for their lives. Reputations get damaged by such extreme measures, but reputations can recover. The complete collapse of a bank or an exchange, however, spells doom. Protecting customers’ assets from further losses is the right move, but lessons need to be learned.

During recessions in the U.S. in the 19th Century, banks found they had overextended themselves by providing cheap loans in abundance. When market conditions soured, they clubbed together to form an additional reserve to prop up the most distressed among them so they could ride out the storm.

Crypto is going through a similar period. But in the hyper-individualized world of digital assets, such collective action might be too radical for some.

2. A whale of a problem

By the numbers: Solend Solana — over 5,000% increase in Google search volume.

Solend DAO, the decentralized autonomous organization (DAO) behind lending protocol Solend, has voted to overturn a decision that would have allowed the network to take control of a “whale” wallet at risk of a liquidation crunch.

- Permission to claim the wallet was initially agreed upon on Sunday, but the DAO voted to veto the decision following a backlash.

- The initial proposal would have granted Solend “emergency powers” to take over the account. If the decision hadn’t been reversed, Solend DAO would have found itself at odds with the industry motto “not your keys, not your crypto,” by preventing a user from accessing their own assets in a personal wallet.

- Pseudonymous Solend founder Rooter on Saturday brought to attention a whale wallet that had borrowed US$108 million worth of USD Coin and Tether’s USDT after locking up 5.7 million Solend SOL tokens, more than 95% of deposits on the platform.

- The wallet is at risk of liquidation if SOL drops to US$22.30. SOL was trading at US$34.28 at press time, according to CoinGecko data.

- The new proposals do not include the so-called emergency powers and extend governance vote times to one day. Solend is expected to devise new proposals to respond to instances in which whale wallets can put the protocol at risk.

Forkast.Insights | What does it mean?

A DAO giveth, and a DAO taketh away. The fascinating story behind the proposed Solend wallet seizure highlights a quiet battle over the ideas that govern the crypto space.

In Solend’s initial proposal, the threat of a whale’s wallet wiping out the assets of thousands of others and potentially toppling the company was greeted with overwhelming support. But the implications of following through with such a radical move are also causing consternation across the crypto community.

Delphi Labs General Counsel Gabriel Shapiro accused Solend of setting a bad precedent that was not only “contrary in every way to the ‘DeFi’ ethos,” but also illegal.

Solend backed down, but the struggle over how hands-on a crypto company should be when it comes to its users’ assets extends far beyond this episode.

Crypto veterans want the companies that build wallets and financial services to have as little control over their assets as possible. Yet the millions of new consumers migrating from Web 2.0 expect a safety net to protect them from nefarious actors and the sheer complexity of the crypto space.

The old guard prevailed this time, but the tension at the heart of the Solend affair is likely to remain unresolved, especially if prices continue to fall.

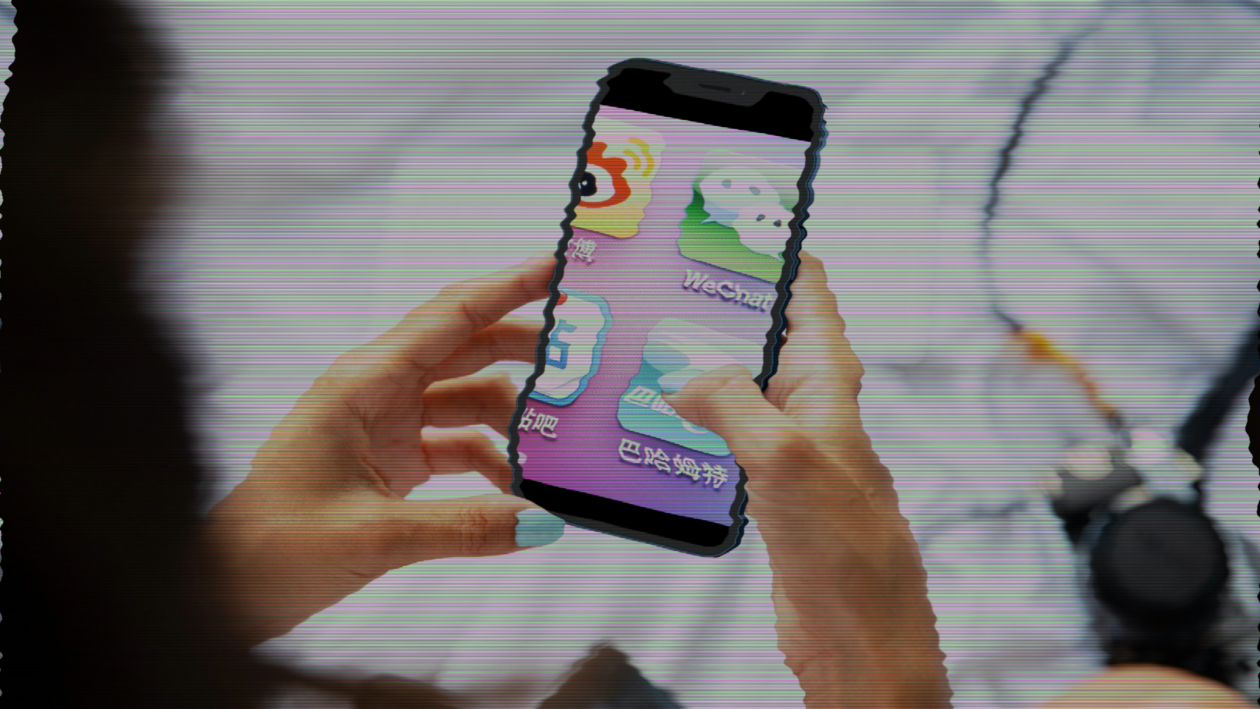

3. No flip-flops

Image: Canva

Chinese mega app WeChat has banned the official account of a domestic non-fungible token (NFT) platform for “business activities related to secondary trading of digital collectibles or cryptocurrency,” as Chinese authorities explore ways to tighten controls over the sprawling sector.

- The NFT marketplace, named NFTea, is a platform on which users can trade “digital collectibles” — which are what NFTs are called in China — featuring high-end tea products.

- Official accounts on the ubiquitous Chinese social messaging app are subject to disciplinary action and even permanent bans if their holders are found to be involved in flipping digital collectibles, according to WeChat’s official account rules.

- Meanwhile, in a recent commentary published by state mouthpiece People’s Daily, Liu Tianjiao, the blockchain copyright director of the National Press and Publication Administration, wrote that digital collectibles would enjoy copyright protection only after reviews. He also wrote that digital collectibles “must align with the country’s core values.”

- Yifan He, chief executive officer of Red Date Technology, the developer behind state-backed Blockchain-based Service Network, previously told Forkast that he saw a bleak future for the industry if market players continued to package NFTs as investment products.

- In April, industry banking, securities and internet finance sector lobby groups urged their members to “resolutely curb” a wave of “financialization and securitization” of NFTs.

Forkast.Insights | What does it mean?

WeChat’s move to censor content related to NFT trading should be seen as reinforcement of China’s overall attitude toward speculation, financialization and securitization involving the emerging asset class.

Although China remains determined to develop blockchain technology on its state-backed Blockchain-based Service Network and has made much progress in deploying infrastructure across the nation, the central government — speaking through the country’s media watchdog and state-backed media outlets — has made it clear that it would not tolerate speculation and copyright infringements related to digital collectibles.

The government of Fujian, a province in Southeastern China, has even reportedly issued a notice to curb secondary trading in digital collectibles, according to local media.

Nonetheless, interest in NFT trading persists, and holders of NFTs are still trading their digital collectibles on Xianyu, the country’s largest online second-hand goods marketplace, owned by Alibaba.

It seems that for as long as flipping digital collectibles remains a profitable business, traders will almost always find a way to circumvent the rules — just like Chinese cryptocurrency miners, who still secretly mine coins despite a strict government ban.